can u go to jail for not filing taxes

2 Penalties for Failure to File. But only if you did so on purpose.

Filing Taxes When Incarcerated How To Justice

The IRS imposes a 5-year prison sentence on anyone who files.

. Yes you can go to jail only if you have violated state tax law and participated in tax fraud. Beware this can happen to you. May 4 2022 Tax Compliance.

Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years. Courts will charge you up to 250000 in fines. You cannot go to jail for making a mistake or filing your tax return incorrectly.

It depends on the situation. While the IRS can pursue charges against you beginning after that first year you fail to file. As we have said filing your taxes is incredibly important and failure to do this is a big deal.

How much do you have. For not paying state taxes you will most likely end up with a fine. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month.

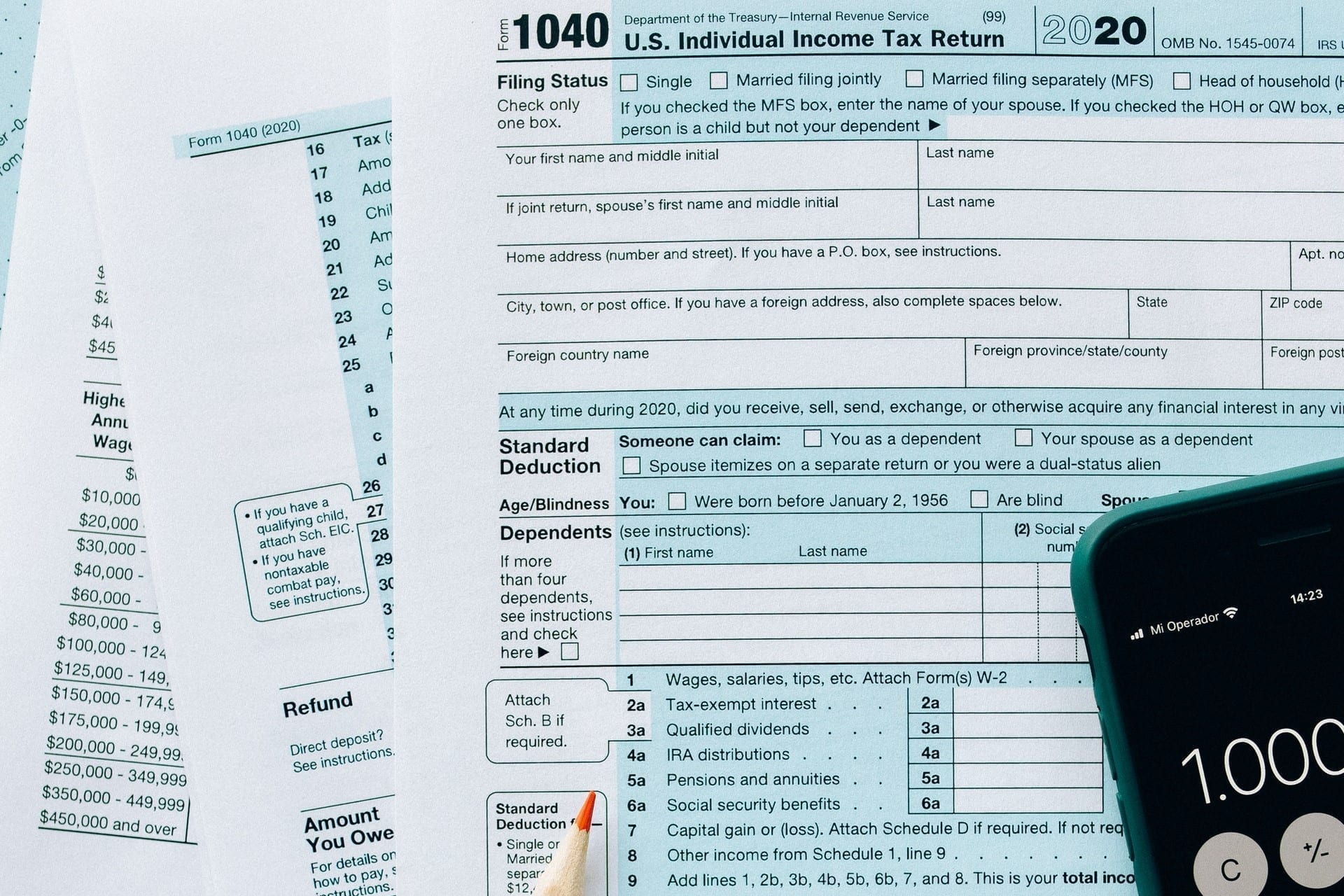

A tax is a compulsory financial charge it may also be some other sort of levy imposed on a taxpayer an individual or company by a governmental organization. How many years can you legally not file taxes. In addition to a prison term the US.

Failure to File a Return. If you have a filing requirement and fail to file the IRS may file a substitute return on your behalf. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail.

Tax Fraud is a criminal offense. In this guide well be taking a look at if. The question can you go to jail for not filing taxes is complicated and multifaceted.

If you cannot afford to pay your taxes the IRS will not send you to jail. Negligent reporting could cost you up to 20 of the taxes you underestimated. The short answer to the question of whether you can go to jail for not paying taxes is yes.

Whether a person would actually go to jail for not. But can you go to jail for not filing your taxes. Are there any remedies.

The short answer is yes you can go to jail for not paying taxes. The short answer is maybe it depends on why youre not paying your taxes. Is not filing a tax return included in tax fraud.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail. The short answer is maybe. There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file.

3 Enforced Collection Actions. Failing to file a return can land you in. 4 The Statute of.

Although it is very unlikely for an individual to receive a jail sentence for. However you can face jail time if you. You can go to jail if you lied on your tax return or didnt file one.

Can you go to jail for filing your taxes wrong. However if your taxes are wrong by design and you intentionally. The following actions can land you in jail for one to five years.

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve.

You Can T Run Or Hide If You Have Past Unfiled Tax Returns Here S What To Do Marketwatch

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

What Is The Penalty For Not Filing Taxes Forbes Advisor

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Income Tax Tax Return Taxact

Houston Area Tax Preparer Sentenced To 3 Years In Prison For Filing More Than 40 Fake Tax Returns Us Attorney Says

Can You Go To Jail For Not Paying Your Taxes Paladini Law

Infamous Tax Crimes Turbotax Tax Tips Videos

Can You Go To Jail For Not Filing Tax Returns Beware This Can Happen To You Tax Attorney Orange County Ca Kahn Tax Law

What Happens If You Don T File Taxes For Your Business Bench Accounting

Irs Audit Penalties And Consequences Polston Tax

What To Do If You Did Not File Taxes How To Avoid Major Penalties

:max_bytes(150000):strip_icc()/tax_help-5bfc357846e0fb00517dc690.jpg)

Why Do So Many People Fall Behind On Their Taxes

What Could Happen If You Don T Do Your Taxes

What Happens If You Can T Pay Your Taxes Ramsey

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

How To File Your Taxes If Your Spouse Is Incarcerated

Who Goes To Prison For Tax Evasion H R Block

Will I Go To Jail If I Refuse To Pay War Taxes National War Tax Resistance Coordinating Committee