maryland tax lien payment plan

For assistance users may contact the Taxpayer Service Section Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or. This electronic government service includes a serviceconvenience.

Thoughtful Planning And Impeccable Execution Have Always Been Our Hallmark House Cost The Fox And The Hound Holiday Decor

Durations of 36 to 60 months are possible.

. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Many counties also have penalty rates included the return which positively affect the overall rate of return. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means.

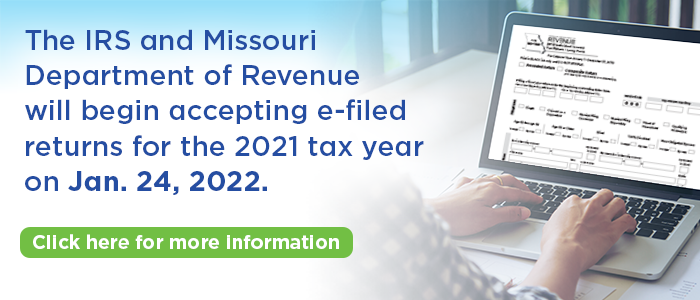

If you already have a tax lien taxpayers can set up a 60-month payment plan with. This is an ongoing. Maryland tax lien payment plan Tuesday April 5 2022 Edit.

You will need your payment agreement number in order to set up an automatic payment. Maryland tax lien payment plan. Check your Maryland tax liens.

The taxpayer is required to make the payment in person and will be given a receipt to provide to MVA to obtain a release. We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs 5 12 7 Notice Of Lien Preparation And. Requests for payment plans should be made by the quarterly due dates of april 30 2022 july 31 2022 november 2 2022 and february 1 2023.

Check your Maryland tax liens. A down payment of less than 10 may be possible for those. If you do not know your notice number call our Collection Section at 410-974-2432 or 1-888-674-0016.

Maryland tax lien payment plan Friday February 25 2022 Edit. However the balance is subject to penalties and interest. You may be required to.

If you need more time fill out Form MD 433-A. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A. File personal income taxes.

The Maryland Comptrollers office is more likely to offer you a 24-month payment plan for your state taxes. After doing so you can visit the applicable circuit court to obtain a certified copy of the lien release. If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov by calling the.

If the monthly payments on your tax. The only way to get a tax lien released is to pay your Maryland tax balance. For business tax liabilities call 410-767-1601.

The rate of return in Maryland varies from 6 24 depending on the county. Just remember each state has its own bidding process. A Maryland tax payment plan allows taxpayers to make monthly payments until the debt is met.

You can apply for a Maryland state tax payment plan by indicating that. Alternative electronic check payment options are available through the office of the Comptroller of Maryland. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax.

It ranges from 3-15 years depending on the state and resets each time you make a payment. Monthly payments must be made. The case began with a Montgomery County man Kenneth R.

How To Avoid A Maryland State Tax Lien

Frequency Content Creativity Your Value Proposition And You Value Proposition Estate Planning Attorney Marketing Program

Tax Liens Background Checks Goodhire

Maryland Tax Payment Plan Tax Group Center

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

Tax Lien Certificate Definition

Does Irs Debt Show On Your Credit Report H R Block

Does The Irs Forgive Tax Liability After 10 Years Omni Tax Help

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Experts Believe China Is Far From Uninterested In Cryptocurrency Despite Its Overt Efforts At Bans Of One Kind Or Anoth Cryptocurrency Bitcoin Bitcoin Currency

Pin On Printable Business Form Template

Payment Plan Agreement Awesome 11 Sample Payment Plan Templates To Download How To Plan Marketing Plan Template Contract Template

Individual Income Tax Electronic Filing